Token Bridging

The Arbitrum protocol's ability to pass messages between L1 and L2 (see L1 to L2 messaging) can be leveraged to trustlessly move assets from Ethereum to an Arbitrum chain and back. Any asset / asset type can in principle be bridged, including Ether, ERC20 tokens, ERC-721 tokens, etc.

Depositing And Withdrawing Ether

To move Ether from Ethereum onto the Arbitrum chain, you execute a deposit transaction via Inbox.depositEth. This transfers funds to the Bridge contract on the L1 and credits the same funds to you inside the Arbitrum chain at the specified address.

function depositEth(address destAddr) external payable override returns (uint256)

As far as Ethereum knows, all deposited funds are held by Arbitrum's Bridge contract.

Withdrawing ether can be done using the ArbSys withdrawEth method:

ArbSys(100).withdrawEth{ value: 2300000 }(destAddress)

Upon withdrawing, the Ether balance is burnt on the Arbitrum side, and will later be made available on the Ethereum side.

ArbSys.withdrawEth is actually a convenience function is which is equivalent to calling ArbSys.sendTxToL1 with empty calldataForL1. Like any other sendTxToL1 call, it will require an additional call to Outbox.executeTransaction on L1 after the dispute period elapses for the user to finalize claiming their funds on L1 (see "L2 to L1 Messages"). Once the withdrawal is executed from the Outbox, the user's Ether balance will be credited on L1.

Bridging ERC20 Tokens

Overview

The Arbitrum protocol itself technically has no native notion of any token standards, and gives no built-in advantage or special recognition to any particular token bridge. Described here is the "Canonical Bridge," which we at Offchain Labs implemented, and which should be the primary bridge most users and applications use; it is (effectively) a DApp with contracts on both Ethereum and Arbitrum that leverages Arbitrum's cross-chain message passing system to achieve basic desired token-bridging functionality. We recommend that you use it!

Design Rationale

In our token bridge design, we use the term "Gateway" as per this proposal; i.e., one of a pair of contracts on two different domains (i.e., Ethereum and an Arbitrum chain), used to facilitate cross-domain asset transfers.

Some core goals that motivated the design of our bridging system:

Custom Gateway functionality

For many ERC20 tokens, "standard" bridging functionality is sufficient, which entails the following: a token contract on Ethereum is associated with a "paired" token contract on Arbitrum. Depositing a token entails escrowing some amount of the token in an L1 bridge contract, and minting the same amount at the paired token contract on L2. On L2, the paired contract behaves much like a normal ERC20 token contract.

Withdrawing entails burning some amount of the token in the L2 contract, which then can later be claimed from the L1 bridge contract.

Many tokens, however, require custom Gateway systems, the possibilities of which are hard to generalize. E.g:

- Tokens which accrue interest to their holders need to ensure that the interest is dispersed properly across layers, and doesn't simply accrue to the bridge contracts

- Our cross-domain WETH implementations requires tokens be wrapped and unwrapped as they move across layers.

Thus, our bridge architecture must allow not just the standard deposit/withdraw functionality, but for new, custom Gateways to be dynamically added over time.

Canonical L2 Representation Per L1 Token Contract

...having multiple custom Gateways is well and good, but we also want to avoid a situation in which a single L1 token that uses our bridging system can be represented at multiple addresses/contracts on the L2 (as this adds significant friction and confusion for users and developers). Thus, we need a way to track which L1 token uses which gateway, and in turn, to have a canonical address oracle that maps the tokens addresses across the Ethereum and Arbitrum domains.

Canonical Token Bridge Implementation

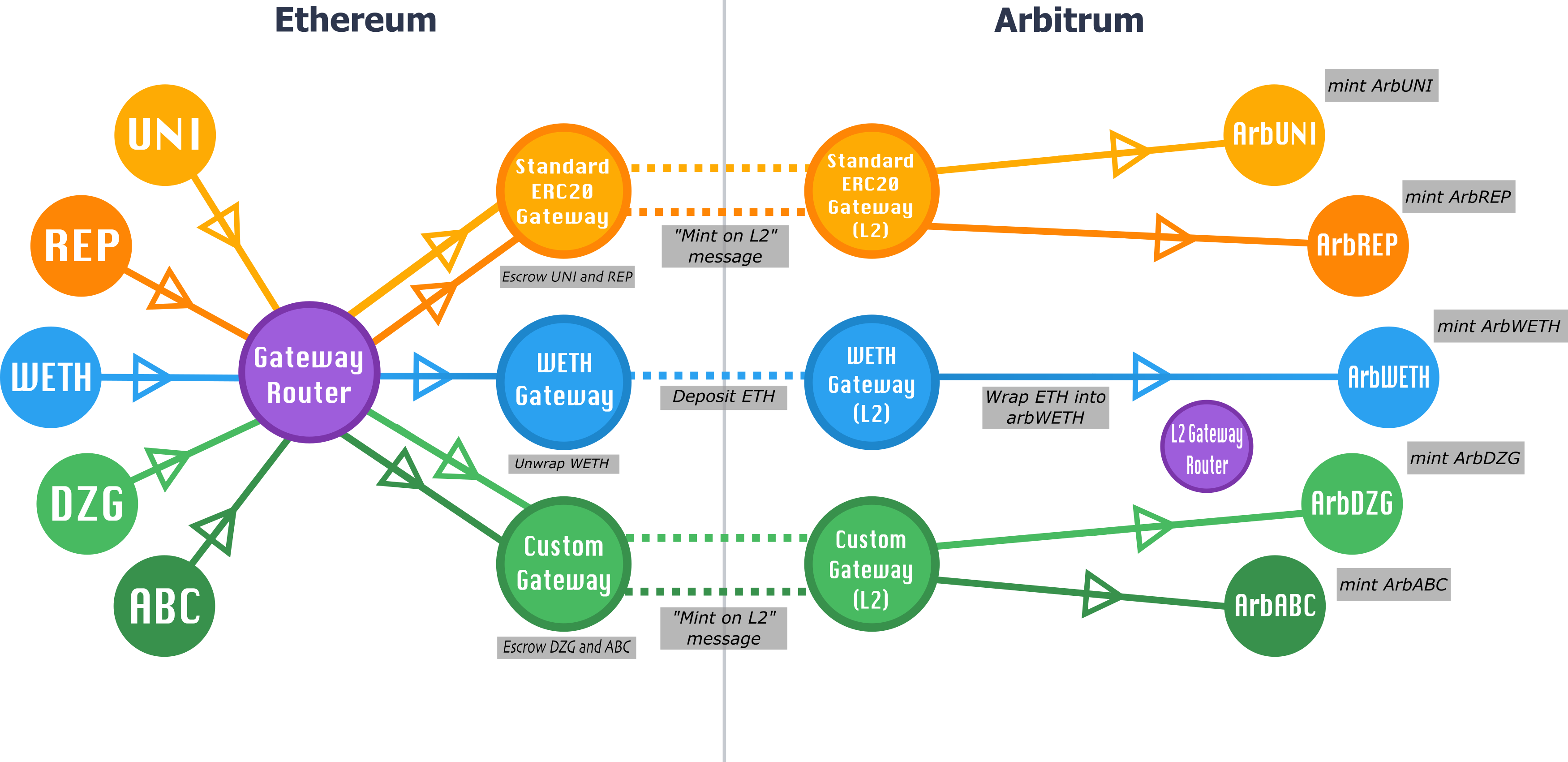

With this in mind, we provide an overview of our token bridging architecture:

Our architecture consists of three types of contracts:

- Asset contracts: these are the token contracts themselves, i.e., an ERC20 on L1 and it's counterpart on Arbitrum.

- Gateways: Pairs of contracts (one on L1, one on L2) that implement a particular type of cross chain asset bridging.

- Routers: Exactly two contracts - (one on L1, one on L2) that route each asset to its designated Gateway.

All Ethereum to Arbitrum token transfers are initiated via the L1GatewayRouter contract. L1GatewayRouter forwards the token's deposit-call to it's appropriate L1ArbitrumGateway contract. L1GatewayRouter is responsible for mapping L1 token addresses to L1Gateway, thus acting as L1/L2 address oracle and ensuring that each token corresponds to only one gateway. The L1ArbitrumGateway communicates to an L2ArbitrumGateway (typically/expectedly via retryable tickets (see Retryable Tickets).

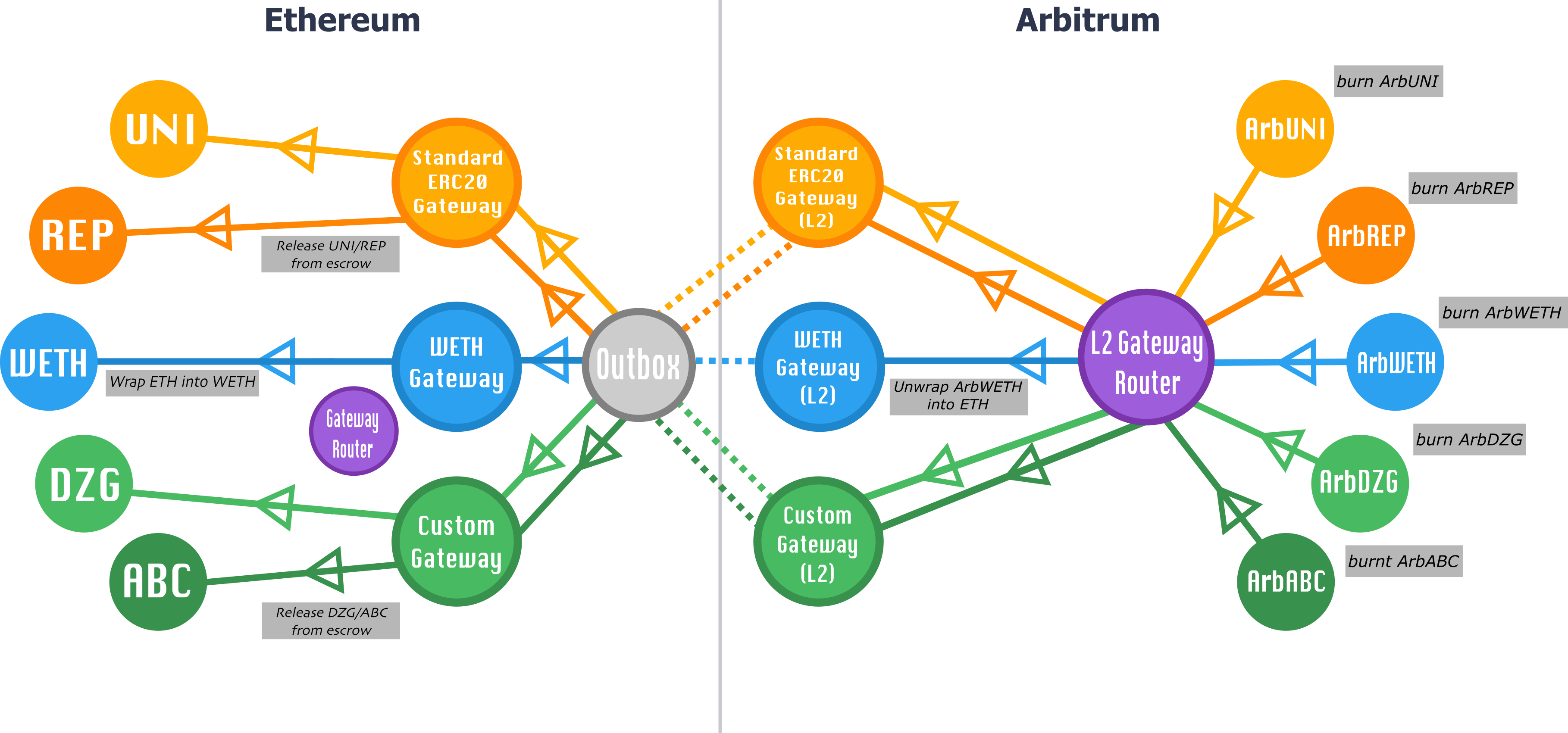

Similarly, Arbitrum to Ethereum transfers are initiated via the L2GatewayRouter contract, which forwards calls the token's L2ArbitrumGateway, which in turn communicates to its corresponding L1ArbitrumGateway (typically/expectedly via sending messages to the Outbox.)

For any given gateway pairing, we require that calls be initiated through the GatewayRouter, and that the gateways conform to the TokenGateway interfaces; the TokenGateway interfaces should be flexible and extensible enough to support any bridging functionality a particular token may require.

Default Standard Bridging

By default, any ERC20 token on L1 that isn't registered to a Gateway can be permissionlessly bridged to the Standard ERC20 Gateway.

You can use the bridge UI or this script to a bridge a token to L2.

Example: Standard Arb-ERC20 Deposit/Withdraw

To help illustrate what this all looks like in practice, let's go through the steps of what depositing and withdrawing SomeERC20Token via our Standard ERC20 gateway looks like. Here, we're assuming that SomeERC20Token has already been registered in the L1GatewayRouter to use the Standard ERC20 Gateway.

Deposits

- A user calls

GatewayRouter.outboundTransferCustomRefund[1] (withSomeERC20Token's L1 address as an argument). GatewayRouterlooks upSomeERC20Token's gateway, and finding that it's Standard ERC20 gateway (theL1ERC20Gatewaycontract).GatewayRoutercallsL1ERC20Gateway.outboundTransferCustomRefund, forwarding the appropriate parameters.L1ERC20Gatewayescrows tokens, and creates a retryable ticket to triggerL2ERC20Gateway'sfinalizeInboundTransfermethod on L2.finalizeInboundTransfermints the appropriate amount of tokens at thearbSomeERC20Tokencontract on L2.

❗️ [1] Please keep in mind that some older custom gateways might not have outboundTransferCustomRefund implemented and GatewayRouter.outboundTransferCustomRefund does not fallback to outboundTransfer. In those cases, please use function GatewayRouter.outboundTransfer.

Note that arbSomeERC20Token is an instance of StandardArbERC20, which includes bridgeMint and bridgeBurn methods only callable by the L2ERC20Gateway.

Withdrawals

- On Arbitrum, a user calls

L2GatewayRouter.outBoundTransfer, which in turn callsoutBoundTransferon arbSomeERC20Token's gateway (i.e., L2ERC20Gateway). - This burns arbSomeERC20Token tokens, and calls ArbSys with an encoded message to

L1ERC20Gateway.finalizeInboundTransfer, which will be eventually executed on L1. - After the dispute window expires and the assertion with the user's transaction is confirmed, a user can call

Outbox.executeTransaction, which in turn calls the encodedL1ERC20Gateway.finalizeInboundTransfermessage, releasing the user's tokens from the L1ERC20Gateway contract's escrow.

The Arbitrum Generic Custom Gateway

Just because a token has requirements beyond what are offered via the StandardERC20 gateway, that doesn't necessarily mean that a unique Gateway needs to be tailor-made for the token in question. Our Generic-Custom Gateway is designed to be flexible enough to be suitable for most (but not necessarily all) custom fungible token needs. As a general rule:

If your custom token has the ability to increase its supply (i.e, mint) directly on the L2, and you want the L2-minted tokens be withdrawable back to L1 and recognized by the L1 contract, it will probably require its own special gateway. Otherwise, the Generic-Custom Gateway is likely the right solution for you!

Some examples of token features suitable for the Generic-Custom Gateway:

- L2 token contract upgradable via a proxy

- L2 token contract includes address whitelisting /blacklisting

- Deployer determines address of L2 token contract

Setting Up Your Token With The Generic Custom Gateway

Follow the following steps to get your token set up to use the Generic Custom Gateway

0. Have an L1 token

- Your token on L1 should conform to the ICustomToken interface; (see TestCustomTokenL1 for an example implementation). Crucially, it must have an

isArbitrumEnabledmethod in its interface.

1. Deploy your token on Arbitrum

- Your token should conform to the minimum IArbToken

interface; i.e., it should have

bridgeMintandbridgeBurnmethods only callable by the L2CustomGateway contract, and the address of its corresponding Ethereum token accessible vial1Address. For an example implementation, see TestArbCustomToken.

2. Register Your Token on L1 to Your Token on L2 via the L1CustomGateway Contract

Have your L1 token's contract make an external call to L1CustomGateway.registerTokenToL2. This registration can alternatively be performed as a chain-owner registration via Arbitrum DAO proposal.

3. Register Your Token on L1 To the L1Gateway Router

After your token's registration to the Custom Gateway is complete, have your L1 token's contract make an external call to L1GatewayRouter.setGateway; this registration can also alternatively be performed as a chain-owner registration via Arbitrum DAO proposal.

| If you have questions about your custom token needs, feel free to reach out. |

|---|

Other Flavors of Gateways

Note that in the system described above, one pair of Gateway contracts handles the bridging of many ERC20s; i.e., many ERC20s on L1 are each paired with their own ERC20s on Arbitrum via a single gateway contract pairing. Other gateways may well bear different relations with the contracts that they bridge.

Take our wrapped Ether implementation, for example: here, a single WETH contract on L1 is connected to a single WETH contract on L2. When transferring WETH from one domain to another, the L1/L2 Gateway architecture is used to unwrap the WETH on domain A, transfer the now-unwrapped Ether, and then re-wrap it on domain B. This ensures that WETH can behave on Arbitrum the way users are used to it behaving on Ethereum, while ensuring that all WETH tokens are always fully collateralized on the layer in which they reside.

No matter the complexity of a particular token's bridging needs, a gateway can in principle be created to accommodate it within our canonical bridging system.

Demos

See token-deposit and token-withdraw for demos of interacting with the bridge architecture via the Arbitrum SDK.

See also custom-token-bridging for a demo on how to set up a custom token to use the Generic-Custom gateway.

A Word of Caution on Bridges (aka, "I've Got a Bridge To Sell You")

Cross chain bridging is an exciting design space; alternative bridge designs can potentially offer faster withdrawals, interoperability with other chains, different trust assumptions with their own potentially valuable UX tradeoffs, etc. They can also potentially be completely insecure and/or outright scams. Users should treat other, non-canonical bridge applications the same way they treat any application running on Arbitrum, and exercise caution and due diligence before entrusting them with their value.